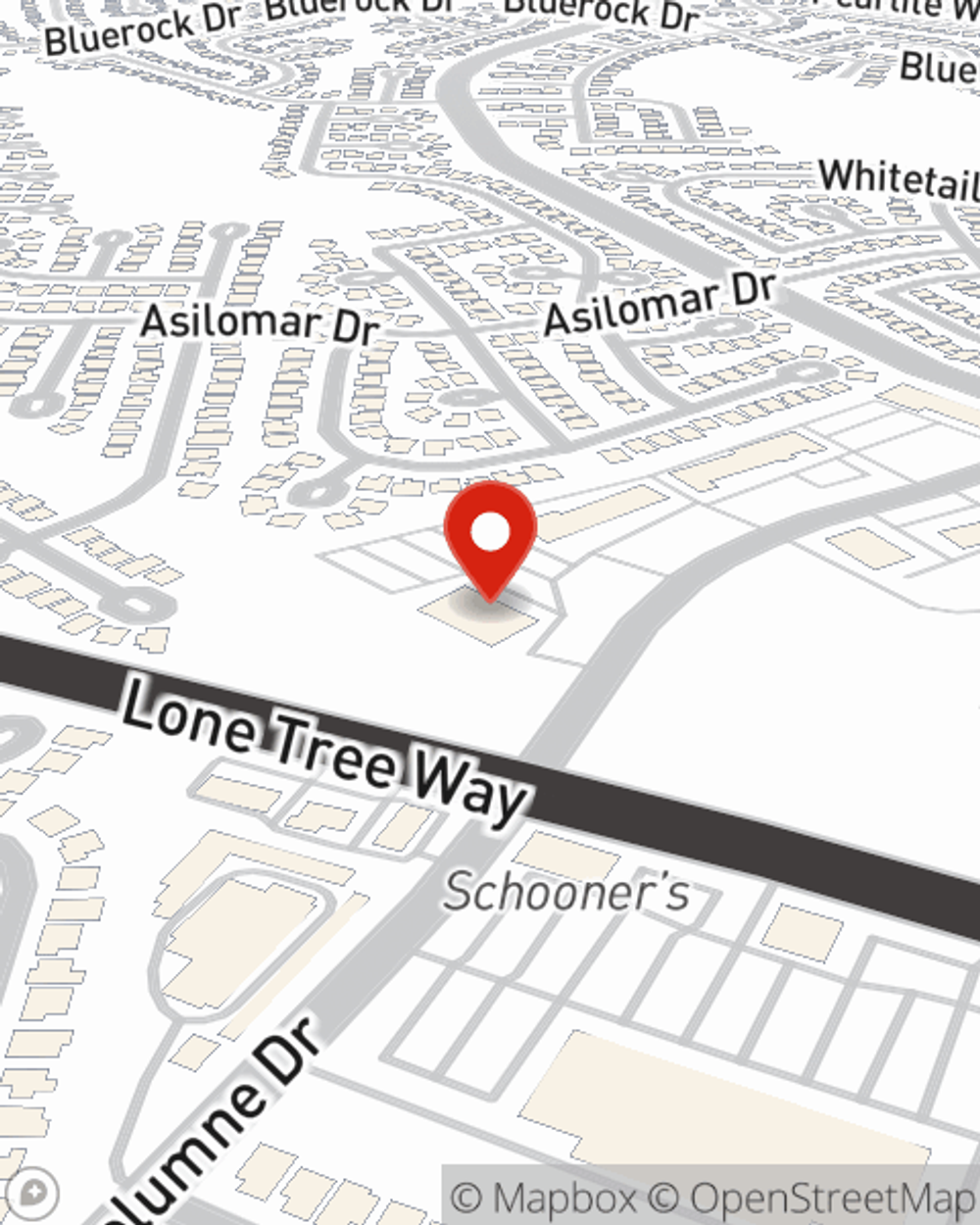

Business Insurance in and around Antioch

Looking for small business insurance coverage?

No funny business here

- California

- Arizona

- Oregon

Coverage With State Farm Can Help Your Small Business.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Chris Pimentel help you learn about excellent business insurance.

Looking for small business insurance coverage?

No funny business here

Customizable Coverage For Your Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your take-home pay, but also helps with regular payroll costs. You can also include liability, which is critical coverage protecting your company in the event of a claim or judgment against you by a consumer.

Visit the excellent team at agent Chris Pimentel's office to find out about the options that may be right for you and your small business.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Chris Pimentel

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.